Charlie Lee, the former director of engineering at Coinbase, is selling almost all of his holdings in Litecoin (LTC), the cryptocurrency that he founded in 2011.

Lee explained in a post on Reddit that he is selling all of his LTC coins — bar a number of physical coins he keeps as collectibles — to avoid the conflict of interest that comes with his influence and position as LTC founder.

Thanks to his time at Coinbase and LTC, Lee is regarded as a key influencer in the crypto space and he has accumulated more than 378,000 followers on Twitter, where his handle is @SatoshiLite. While he said he has stayed away from tweeting about LTC prices directly, he acknowledged his tweets have been criticized in some quarters as manipulating the price despite whatever his best interest. Lee readily admits that his position represented a conflict of interest, hence the unload.

“Whenever I tweet about Litecoin price or even just good or bads news, I get accused of doing it for personal benefit. Some people even think I short LTC! So in a sense, it is conflict of interest for me to hold LTC and tweet about it because I have so much influence. I have always refrained from buying/selling LTC before or after my major tweets, but this is something only I know. And there will always be a doubt on whether any of my actions were to further my own personal wealth above the success of Litecoin and crypto-currency in general,” Lee wrote.

We don’t know how many LTC that Lee held, and had sold, but now he said he is focused on developing the cryptocurrency itself.

“This is definitely a weird feeling, but also somehow refreshing. Don’t worry. I’m not quitting Litecoin. I will still spend all my time working on Litecoin. When Litecoin succeeds, I will still be rewarded in lots of different ways, just not directly via ownership of coins. I now believe this is the best way for me to continue to oversee Litecoin’s growth ,” he added.

Note that Lee’s brother — Bobby — is the founder of China’s largest exchange BTC China, so this is definitely a powerful crypto family.

Like Bitcoin, Ether and others, Litecoin’s value has grown explosively this year.

It is the world’s fifth larger cryptocurrency, according to Coinmarketcap.com, with a total ‘market cap’ of more than $2 billion. It’s value, at the time of writing, is $330.14 per coin, up more than 75X from just $4.36 on January 1, 2017.

Trading volumes of the coin have also reached unprecedented levels at the tail end of 2017, as indicated in the bottom graph in the chart below.

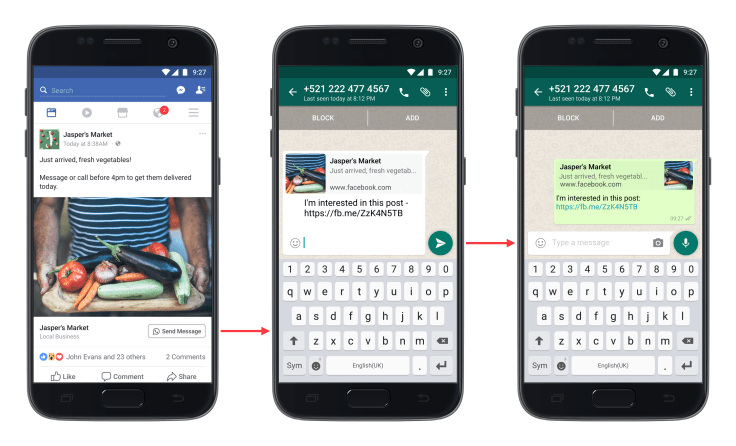

We reported early sightings of the feature in test mode

We reported early sightings of the feature in test mode